Understanding Mutual Funds: A Beginner’s Guide to Smarter Investments

Introduction: Why Mutual Funds Are the Go-To Investment for All

Investing can feel like navigating a maze. Questions like “Where should I start?”, “What’s safe?”, and “How do I grow my wealth?” may leave you overwhelmed. Mutual funds simplify investing by offering a professionally managed, diversified portfolio for everyone—from first-timers to experienced investors. This guide will explain mutual funds in depth, covering how they work, their types, benefits, risks, and practical examples, along with answers to common questions.

What Are Mutual Funds?

A mutual fund is an investment vehicle that pools money from several investors. This pool is managed by a professional fund manager, who allocates it across various financial instruments like stocks, bonds, and other assets.

Key Features:

- Professional Management: Experts handle your investments.

- Diversification: Your money is spread across multiple assets, reducing risk.

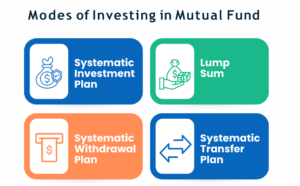

- Accessibility: Start with as little as ₹500 through Systematic Investment Plans (SIPs).

- Liquidity: Withdraw or redeem your investments with ease.

Analogy:

Imagine you and a group of friends pooling money to hire a chef. The chef uses their expertise to prepare a feast, ensuring everyone enjoys a great meal. In the world of mutual funds, the chef is the fund manager, and the feast is your return on investment.

How Do Mutual Funds Work?

- Pooling Capital: Investors contribute money to the fund.

- Professional Allocation: The fund manager invests in equities, debt, or hybrid instruments, depending on the fund’s objective.

- Returns Generation: Based on market performance, the fund generates returns.

- NAV Calculation: Returns are reflected in the Net Asset Value (NAV), which determines the value of your investment.

Types of Mutual Funds

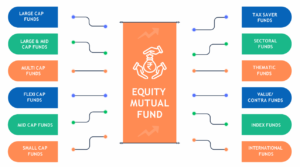

1. Equity Funds

- Invest in shares of companies.

- Aim for high returns over the long term.

- Suitable for investors with a higher risk tolerance.

- Example: A large-cap fund invests in established companies like TCS and Reliance.

2. Debt Funds

- Invest in fixed-income securities like government bonds.

- Offer steady returns with lower risk.

- Example: Liquid funds are ideal for parking short-term cash.

3. Hybrid Funds

- Combine equities and fixed-income instruments for balanced growth.

- Suitable for moderate-risk investors.

- Example: Balanced Advantage Funds.

4. Index Funds

- Mirror a specific market index like Nifty 50.

- Passively managed, making them cost-effective.

Benefits of Investing in Mutual Funds

1. Diversification:

Spreads your risk by investing in multiple sectors and asset classes.

2. Expert Management:

Access to skilled fund managers who monitor and optimize your investments.

3. Flexibility:

Choose between SIPs, lump sums, and various fund types based on your goals.

4. Affordability:

Start small and gradually increase your investment over time.

5. Tax Efficiency:

Equity-linked funds offer tax benefits under Section 80C of the Income Tax Act.

Example: Mutual Fund Investment in Action

Scenario: Ravi, aged 30, wants to save ₹10 lakhs in 10 years for his child’s education.

Solution: He invests ₹5,500 per month in an equity mutual fund offering 12% annual returns.

Calculation:

Using a SIP calculator:

- Monthly SIP: ₹5,500

- Tenure: 10 years

- Expected Return: 12%

- Total Corpus: ₹11.5 lakhs (exceeding his target).

Risks Involved in Mutual Funds

Market Risk:

Equity funds may fluctuate with stock market volatility.Interest Rate Risk:

Debt funds are affected by changes in interest rates.Liquidity Risk:

Some funds, like ELSS, have lock-in periods.Inflation Risk:

Low-return funds might not beat inflation.

FAQs About Mutual Funds

Q1. Can I lose all my money in mutual funds?

- Not entirely. Diversification ensures that losses in one investment may be offset by gains in others.

Q2. What is the minimum duration for investing in mutual funds?

- Equity funds require a horizon of at least 5 years to mitigate market volatility.

Q3. Are mutual funds better than stocks?

- Mutual funds offer diversification and professional management, making them less risky than individual stocks.

Q4. How are mutual funds taxed?

- Equity funds attract long-term capital gains tax (10%) after 1 year. Debt funds are taxed differently based on your holding period.

Q5. Can I invest in mutual funds without a financial advisor?

- Yes, but advisors help tailor investments to your goals, ensuring better decision-making.

Common Mistakes to Avoid

Ignoring Risk:

Always match the fund type with your risk appetite.Short-Term Thinking:

Mutual funds thrive over the long term. Avoid frequent withdrawals.Over-Diversification:

Too many funds can dilute your returns.Chasing Past Performance:

Focus on consistency rather than high historical returns.

Conclusion: Start Your Investment Journey Today

Mutual funds are a fantastic way to grow wealth while managing risk. Whether you’re a seasoned investor or a complete beginner, there’s a mutual fund tailored for your needs. The sooner you start, the greater the benefits of compounding.